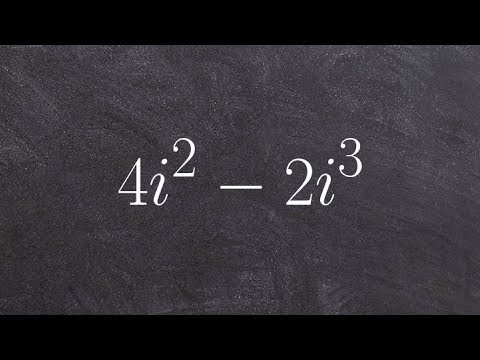

All right, what the sprawl is asking us to do is put this expression into standard form. Well, to scope things, we need to know the first thing: we need to know that standard form is a + bi, where a represents the real number and b represents the imaginary number. Now, what we have is, we don't have an 'i', we have an 'I squared' and an 'I cubed'. So, I'll do a little overview of what 'i' is. We're going to let 'i' represent the square root of -1 because we can't take the square root of a negative number. So, we're going to have 'i' represent the square root of -1. Most x on both sides, I'll get 'i squared' equals -1. If I represent the square root of -1 squared, so therefore, those cancel out and I'm left with -1. You can work it out to square both sides and you'll see that if I was 'x' on both sides again, I'll get 'i cubed'. 'i squared' times 'i cubed' and then get what's that? 'i' will be a negative 'i'. 'i' to the fourth equals again, we have a square root, so we're doing a negative square, so we have -1 squared, which would be -1. And the -1 would cancel out to give you 1. So, after all that working over there, I have videos I'm going to show that, you know, we can. I want to spend time working this, how to work this problem in standard form. So, I need to get it into a real number and an imaginary number. Right now, I have -4 + 2i. Well, what I can do is I can rearrange my 'i squared' my 'i cubed'. So, my 'i squared' can represent -1, minus 2...

Award-winning PDF software

3921 Form: What You Should Know

As the basis for the exercise, the employee must use, for example, a Form 1099 or equivalent. Form 3921 is not a tax form. The IRS will simply notify all the involved parties via e-mail and have them fill out Form 3921 and give it to the IRS. Any form with the IRS logo or other identifying mark is treated as informational and is not a tax form. Form 3921 — The Employee's Options Incentive stock options granted in 2025 generally have a vesting schedule during years in which the options are issued. This means that during the vesting period when an employee exercises an ISO, the vesting schedule will determine the number of shares that remain available for future grants to the employee. An ISO generally has a four-year vesting schedule. In addition, you should take into account the potential change in ownership of the business. See Form 6252 — Employee Stock Purchase Agreement. A stock purchase agreement (the “Purchase Agreement”) is a written contract between an investor (i.e., the “Investor”) and you (the “Company”). Under the Purchase Agreement, investors agree to fund a company or entity and buy additional shares of that entity through cash, checks, or money orders. In exchange, the Investor must also purchase certain underlying assets, such as the stock of the Company, at a set price. This purchase may be made in two ways: 1.) via cash advance or bank draft; and 2.) through the Company's share price. The terms under which the Investor is purchasing additional stock and the price for such stock are usually specified in the Offer to Purchase agreement that the Investor agrees to and that specifies the purchase terms. A Purchase Agreement will be filed on Form 8-K. Tax Benefits — When a Share Option is Purchased With Cash Tax law allows the Company to elect to treat a payment in the form of a cash advance or bank draft made with respect to the vesting of an ISO as a payment received for stock. Thus, if an ISO is exercised, the investor receives the value of the stock. If the amount of the investor's cash payment of stock (in proportion to the amount received) equals or exceeds the fair market value of the stock as of the issuance date, the stock is treated as received. The fair market value is determined under the rules of sections 864 and 865.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3921, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3921 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3921 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3921 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 3921 Form