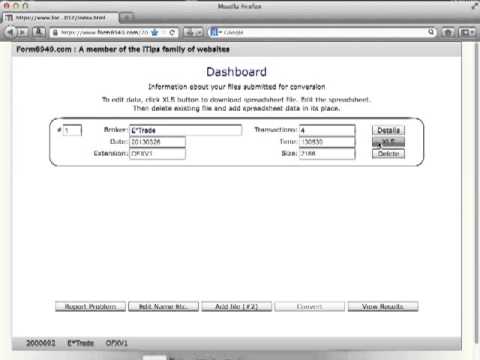

This brief video describes the workflow we recommend you follow while using our product. Start our application and go through the introductory screens to enter your email address and receive your assigned passcode. If your broker sponsors a nofx server, we recommend that you download and process the ofx file created by your broker. Enter your broker user credentials at this point. After you see that data has been received from the broker ofx server, click "Next" and wait for the data to process. When you arrive at the result screen, download and save to your computer all of the PDF files generated by the program. Here, you click the "Incomplete" button and on the next page, select "Edit." This will take you to the application's dashboard screen. Download from the dashboard the spreadsheet generated by the program by clicking the "xls" button. If you have data from another broker account, repeat the process. For example, if you have downloaded a CSV file from your broker website, you would submit that for processing, then download the PDF and xls files for that account. You can then close your browser window and review your data offline as necessary. Edit your spreadsheet file for any missing information or corrections that need to be applied. When you are finished with editing, return to the application and from the dashboard screen, click the "Delete" button to remove the old data and click the "Add" button to submit your edited spreadsheet in its place. Repeat the process until all of your data is complete and accurate. At that point, go to the PayPal secure payment site to pay for and receive your final conversion results.

Award-winning PDF software

3921 carta Form: What You Should Know

Also, how to file IRS Form 3921 for TCC's to be included on Form 2555 to report the value of each stock option. The Employee ISO Exercise Report for the 2025 – 2025 Performance Period The IRS recently issued notice to all filers that when performing their annual IRA/SEP withdrawal (EID) and a portion of their SEP withdrawal (SEP-EZ), they should complete their 2025 – 2025 annual IRA/SEP withdrawal using Form 1099-B by the June 15th deadline. Employee Excess Stock To avoid late fees, I'd suggest following the same form filing schedule. In fact, that's exactly what I'm doing. To get started, I am submitting Form 3921 due April 7, 2019. To be consistent with the information on Form 3921 for an employee exercise, I would suggest that every employee have Form 3599 to pay for the IRA/SEP withdrawal. The most important thing is the date. It is very important to have an accurate date if you need to submit any form for payment purposes in order for the IRS to pay on a timely basis. You do not want to send them an incorrect report, and that could cost you thousands of dollars. In other words, it is important to use form 3921 for the 2025 – 2025 performance period, even if you do not have Form 3599. In this example, we will use only Form 3921. You can use Form 3921 for any person to exercise a stock option from June 15 – July 15 of the 2025 performance period. In this example, we are looking at the exercise date of July 15, 2018. Using this form, you will be able to calculate the amount paid to each person for the exercise of an incentive stock option. In my example, the person that has the most restricted stock has had the most restricted stock paid out by filing Form 3921. When that employee completes their Form 3921 payment, the employee pays 500 to the IRA/SEP-EZ account under the name of the employer. In my example, the total cash value paid out in the form of an incentive stock option payment is 4,500.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3921, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3921 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3921 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3921 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 3921 carta